How Americans Can Consolidate Debts With Personal Loans In 2023

Average Americans have been struggling financially, and as we enter a new year, the issue remains unaddressed. To begin with, the inflation rate was on the rise throughout last year – and it is very likely to go up even more.

Throughout the year, average American households struggled to make ends meet. Thus, they turned to debts and loans as a ray of hope. According to the latest report from Fiscal Data, the national debt has crossed $106 billion. The report suggests that the national debts are increasing every year, and last year, it was the highest of all.

Twitter / With inflation on the rise and recession looming over the heads of Americans like a swinging sword, Americans can’t help but rely on personal loans.

Thus, average Americans are struggling to make ends meet and to cope with this, they rely on personal loans. Although it is resolving the matter for the time being, it is only making it worse in the long run. As a result of these massive personal loans, national debts are increasing unprecedently.

At this point, it is a sensible idea to sit back and think about the consolidation of the debts. Because one day or the other, you are entitled to pay them off. One of the effective ways of consolidating your debts can be possible through your personal loans, financial experts suggest.

Tawfiqu / Unsplash / With debt consolidation loans, you can easily pay off your debts without being financially stressed out.

There is a unique kind of personal loan called a debt consolidation loan. It is an effective and easy-to-achieve way of paying your debts. Here is how you can effectively pay off your through debt consolidation loans – without being financially stressed out:

How Can You Pay Off Your Debts Through Debt Consolidation?

As mentioned above, a debt consolidation loan is a specific type of personal loan. This method allows you to collect all of your debts in one place and pay them off step by step. In other words, you can convert all of your debts in one place through debt consolidation loans.

Karolina / Pexels / Debt consolidation loan is an effective way of streamlining your debts and paying them off through achievable thresholds.

So, here is how it works: You bring all of your debts into one place and pay them off in streamlined steps. This means that you do not have to pay the chunks of debt that you owe. Instead, all of your debts will be streamlined through debt consolidation. And you can pay them off by setting an achievable milestone for yourself.

The purpose of debt consolidation loans is to manage various debts in a single place through streamlined debt management. It makes the process of paying debts easier, more effective, and more achievable.

So, in 2023, make paying off your debts your foremost resolution of the new year. Head over to the debt consolidation technique to see if it is something that will be handy for you in paying off your debts. Rest assured, we are pretty confident to recommend debt consolidation for every household that is struggling with multiple loans all at the same time.

More in Investments & Savings

-

`

What Do I Need to Open a Business Bank Account? Here’s Your Ultimate Guide

Opening a business bank account is a crucial step in setting up your new venture. This process separates your personal and...

June 1, 2024 -

`

How Much Bitcoin Does Blackrock Own? Inside the Mega Investment

Have you ever wondered how the giants of the investment world are navigating the buzzing landscape of cryptocurrency? Amidst various traditional...

May 25, 2024 -

`

What Is Cardi B’s Ethnicity? Her Powerful Reaction to Ongoing Identity Debates

Belcalis Marlenis Cephus, known professionally as Cardi B, the fiery rapper known for her unapologetic presence and bold lyricism, recently reignited discussions...

May 19, 2024 -

`

How Target Stocks Rises and What It Means for Your Investments

When target stocks rise, even by a modest margin, it can signal significant shifts in the broader market landscape. Take, for...

May 12, 2024 -

`

Why Being a Celebrity Means Big Business

In today’s media-driven world, celebrities are more than just famous people. They are also big businesses. From endorsements and sponsorships to...

May 3, 2024 -

`

Is Tesla a Good Stock to Buy? A Look into Tesla’s Earnings and Future

When it comes to electric vehicles, Tesla has been the talk of the town for quite some time. With its innovative...

April 27, 2024 -

`

Why Mutual Fund Taxes Can Eat Into Your Earnings

Investing in mutual funds has long been a favoured avenue for individuals seeking to grow their wealth. Offering diversification, professional management,...

April 26, 2024 -

`

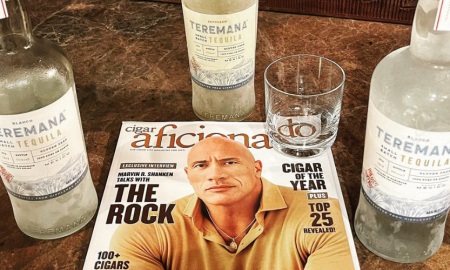

The Rock Tequila Takes Center Stage as Tequila of the Year

Dwayne “The Rock” Johnson isn’t just a wrestling legend and Hollywood A-lister; he’s also the mastermind behind a tequila brand that’s...

April 19, 2024 -

`

World’s Second Richest Man Elon Musk Lives in A Shockingly Simple Two-bedroom House

When you think of Elon Musk, images of cutting-edge technology, space exploration, and high-end electric vehicles might spring to mind. However,...

April 12, 2024

You must be logged in to post a comment Login