Are House Prices Going Down in Orange County in 2024?

In June 2024, Orange County saw a notable shift in its real estate landscape. This leads many to wonder if house prices are going down in Orange County later this year. The dynamics of the market are complex, influenced by various factors that could push prices in different directions.

Let’s explore these factors and what they mean for the future of Orange County’s housing market.

Current Market Trends: Are House Prices Going Down in Orange County?

In June 2024, the total number of home sales in Orange County dropped by 17.1% month-over-month (MTM) and 11.9% year-over-year (YoY). This decline signals a slowing market, a significant shift from the brisk sales pace witnessed in previous months.

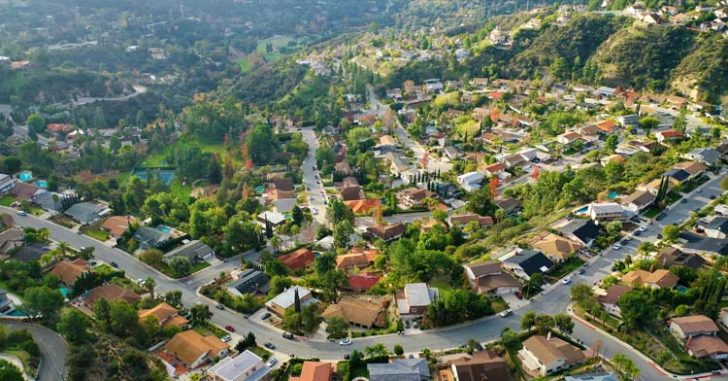

Filter / Unsplash / As buyers become more cautious, home sales in Orange County dropped by a whopping 17% in June 2024.

However, the median sold price of existing single-family homes defied this trend, escalating to $1,450,000, marking a 1.9% increase from May 2024 and a 15.1% surge from June 2023.

Economic Uncertainty and Housing Market Stability

Economic conditions play a crucial role in housing market dynamics. Factors such as job growth, inflation, and consumer confidence impact buying power and market stability. In Orange County, economic uncertainty might be causing some buyers to hold off on purchasing decisions. However, the area’s overall economic health – with diverse industries and relatively low unemployment – continues to support the housing market.

Plus, buyer sentiment is shifting. Potential buyers, observing the current slowdown, might be waiting for a more favorable time to purchase, hoping prices will drop. This wait-and-see approach can lead to fewer transactions and possibly some price adjustments.

However, the significant price increase over the past year indicates that any potential price decline might not be as steep as some buyers hope.

What Factors Contribute to Market Slowdown?

Rising interest rates have made borrowing more expensive, dampening the enthusiasm of potential buyers. Economic uncertainty also plays a role, with concerns about job security and inflation influencing people’s willingness to invest in property.

Apart from that, changing buyer sentiment, where some buyers anticipate further price drops and thus delay their purchases, impacts the market.

Bubble Market / Higher rates mean higher monthly payments, reducing the pool of eligible buyers. This can lead to decreased demand, potentially putting downward pressure on prices.

Yet, in Orange County, despite rising rates, the median home price has continued to increase. This anomaly suggests that while demand may be waning, there is still enough market strength to sustain price growth for now.

Future Predictions About the Orange County Housing Market

Predicting future house prices involves analyzing current trends and projecting their impacts. Given the current data, it is clear that while the number of sales is declining, prices have not followed suit. This resilience suggests that while some market softening may occur, a substantial drop in prices is unlikely in the immediate future.

Supply and demand are fundamental in determining house prices. Orange County has historically experienced a supply shortage, contributing to sustained price increases. If supply remains tight, it could continue to prop up prices even if demand softens. Monitoring new construction and housing inventory levels will be crucial in predicting future price movements.

Apart from that, external economic factors, such as federal monetary policy and global economic conditions, also play a role. Changes in federal interest rates or significant economic events could influence Orange County’s housing market.

For instance, if the Federal Reserve continues to hike rates, mortgage rates will climb, potentially reducing demand further. Conversely, any economic stimulus or improvements in job growth could bolster market confidence.

More in Investments & Savings

-

`

New ‘Medicare Card’ Scam Is On the Rise – Here’s What You Should Do

Have you recently received a call asking you to verify your Medicare number to get a new card? If so, be...

September 13, 2024 -

`

What Is a Stock Split? Understanding How It Works

Stock splits are a fascinating aspect of the financial world that often pique investors’ curiosity. When a company announces a stock...

September 6, 2024 -

`

Cardi B No Makeup: Proof That She’s a Natural Beauty Queen

Cardi B is known for her bold and extravagant style, often capturing attention with her vibrant fashion choices and daring beauty...

August 31, 2024 -

`

How Long Has Forbes Been in Business? – And What Lies Ahead

For over a century, Forbes has been a pillar of business journalism and financial reporting. Since its inception in 1917, Forbes...

August 21, 2024 -

`

What Are Specified Investment Products? SIPs Explained

Navigating the world of investing can be complex, especially when it comes to Specified Investment Products (SIPs). These financial instruments often...

August 7, 2024 -

`

Why Leonardo DiCaprio Never Dated Kate Winslet: The Iconic Duo’s Relationship Update

It has been 25 years since Titanic’s release, a film that has left an indelible mark on the hearts of audiences...

July 29, 2024 -

`

How to Start Your Own Private Bank

Starting your own private bank might sound challenging, but with the right planning and execution, it’s entirely feasible. The benefits of...

July 23, 2024 -

`

Nvidia Stock Now Continues to Drop After Bull Run: What Went Wrong?

After a period of massive growth, Nvidia’s stock is now experiencing a significant drop in value. This California-based software company, known...

July 17, 2024 -

`

Is Kevin O’Leary Conservative? Analyzing His Policies

Kevin O’Leary, the renowned chairman of O’Leary Financial Group, has set the political stage abuzz with his recent announcement. On Wednesday, he...

July 8, 2024

You must be logged in to post a comment Login