Here’s All You Need to Know About Private Banking

When it comes to banking, you have a place where you can go and store your income and your savings so that it remains safe. It consists of you visiting the bank and getting in touch with several bank employees who assist you with the best banking experience.

This is what banking is like for most people, however, people who have specific goals in mind can opt for private banking. So, if you are interested in knowing more about private banking then keep reading because this guide will inform you about all you need to know.

Anete/Pexels | Private Banking is quite beneficial for people who have little time on their hands and a lot of work to do

Defining Private Banking

Private banking is also known as relationship management since this kind of banking consists of clients working with a specific team or an individual to help them with their financial and banking tasks. Now, you might be wondering how that helps.

Unlike a random bank teller, a private banker can help with everything that the client requires as they are already aware of the financial situation and are in the ideal position to recommend suggestions.

Apart from that, private banking also helps in aiding clients with their general everyday tasks such as paying bills, managing their wealth, and more. So, when you opt for private banking, you get a single or a team that coordinates the banking and financial needs.

Energepiccom/Pexels | A hundred problems, one banking partner to do it all

Private Banking Services Provided

There are numerous services that private banking offers. But, services vary from time to time. However, the following are some common services you are bound to find in every bank.

1. Preferential Pricing and Rates on Deposit Accounts

Private Banking is like getting a luxurious hotel room whereby you get some complimentary champagne or a discount package deal. Similarly, people who opt for private banking are eligible for higher APYs, CDs, and interest-bearing checking accounts. These people can also benefit from lower fees and sometimes even waived fees on their banking activity.

2. Financial Planning

Since you have a designated person to take care of all of your banking needs, they have experience handling financial situations, so they are in the perfect position to help you by giving you financial advice and guiding you with important decisions.

3. Lending

Private banking comes with its perks, including getting loans for luxury items that you might not get when you don’t have a personal banker. Your coordinator can easily arrange a loan for you, whether it is for housing, commercial, or investment property.

Matthias/Pexels | Just be prepared for lots of paperwork

If you ask this, private banking sounds like a privilege on its own, but there are certain requirements that you need to meet before you ask your bank for private banking services.

More in Investments & Savings

-

`

What Do I Need to Open a Business Bank Account? Here’s Your Ultimate Guide

Opening a business bank account is a crucial step in setting up your new venture. This process separates your personal and...

June 1, 2024 -

`

How Much Bitcoin Does Blackrock Own? Inside the Mega Investment

Have you ever wondered how the giants of the investment world are navigating the buzzing landscape of cryptocurrency? Amidst various traditional...

May 25, 2024 -

`

What Is Cardi B’s Ethnicity? Her Powerful Reaction to Ongoing Identity Debates

Belcalis Marlenis Cephus, known professionally as Cardi B, the fiery rapper known for her unapologetic presence and bold lyricism, recently reignited discussions...

May 19, 2024 -

`

How Target Stocks Rises and What It Means for Your Investments

When target stocks rise, even by a modest margin, it can signal significant shifts in the broader market landscape. Take, for...

May 12, 2024 -

`

Why Being a Celebrity Means Big Business

In today’s media-driven world, celebrities are more than just famous people. They are also big businesses. From endorsements and sponsorships to...

May 3, 2024 -

`

Is Tesla a Good Stock to Buy? A Look into Tesla’s Earnings and Future

When it comes to electric vehicles, Tesla has been the talk of the town for quite some time. With its innovative...

April 27, 2024 -

`

Why Mutual Fund Taxes Can Eat Into Your Earnings

Investing in mutual funds has long been a favoured avenue for individuals seeking to grow their wealth. Offering diversification, professional management,...

April 26, 2024 -

`

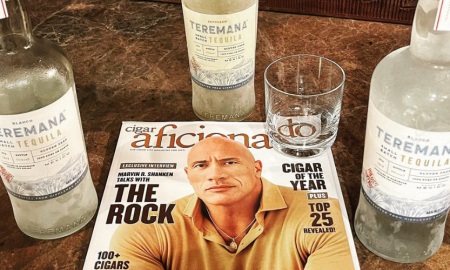

The Rock Tequila Takes Center Stage as Tequila of the Year

Dwayne “The Rock” Johnson isn’t just a wrestling legend and Hollywood A-lister; he’s also the mastermind behind a tequila brand that’s...

April 19, 2024 -

`

World’s Second Richest Man Elon Musk Lives in A Shockingly Simple Two-bedroom House

When you think of Elon Musk, images of cutting-edge technology, space exploration, and high-end electric vehicles might spring to mind. However,...

April 12, 2024

You must be logged in to post a comment Login