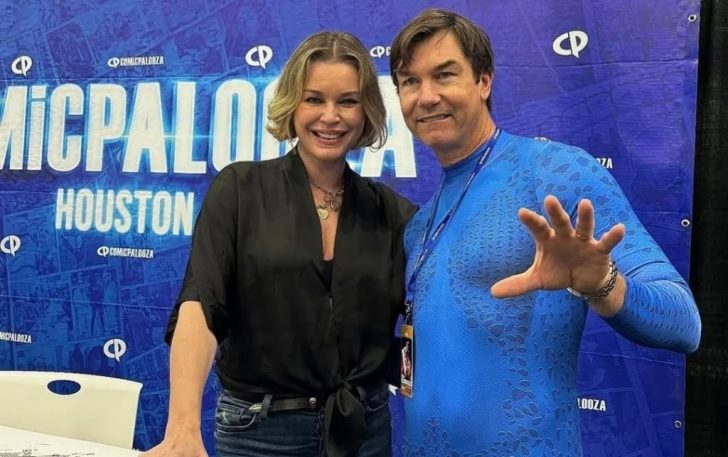

Jerry O’Connell and Rebecca Romijn Have Separate Bank Accounts & It Works!

Jerry O’Connell, 51, and Rebecca Romijn, 52, have been married since 2007. The duo recently spoke on SiriusXM’s “Andy Cohen Live” about how they handle money. They keep separate bank accounts, and yet they run a smooth household with two teenagers.

Rebecca Romijn said they each maintain their own bank accounts. This setup allows them to spend freely without questioning each other, creating a sense of independence that both of them value after years in a demanding industry.

The lovebirds agreed early in their marriage to create a shared account just for their daughters’ needs. From school supplies to healthcare bills, this account holds contributions from both parents.

Romijn explained that discussing finances was one of their first serious conversations as a couple. They wanted to be clear before merging lives and responsibilities.

Both actors keep their individual spending private. O’Connell can buy what he wants from his own account without consulting Romijn. She can do the same, and that freedom has removed typical arguments over purchases.

However, the “Love Locks” and “Endangered Species” co-stars do not split contributions evenly every month. Whoever is “earning more” at the time “adds more” to the shared pot. And the one who is not working “gets a little break.”

Every dollar in their joint pot goes toward Charlie and Dolly, their 16‑year‑old twins. They decided long ago that their girls’ needs would always come first. This clear purpose makes it easy to agree on where shared funds go.

Rebecca / IG / Jerry O’Connell and Rebecca Romijn have been maintaining “completely separate personal bank accounts” since their marriage in 2007. The lovebirds contribute to a shared “community pot” for their 16-year-old twin daughters, Charlie and Dolly.

The Duo Coordinates Careers Around Home Life

The couple plans their work so that at least one parent is home with their daughters. They choose projects with family time in mind. This method strengthens their parenting while protecting the rhythm of their household.

When Andy Cohen joked about O’Connell’s post‑The Talk job changes, Romijn laughed and admitted she never tracks his earnings. Their separate bank accounts mean neither monitors the other’s income, which lowers stress about sudden shifts.

They are responsible for their own bills and credit cards. If O’Connell overspends, it affects only him. Romijn has her own system for her expenses, and that separation keeps mistakes from spilling over.

The couple checks the shared account regularly to stay aligned. If costs for their daughters rise, they talk about increasing deposits. These short check‑ins keep their system current without long financial meetings.

Over nearly two decades of marriage, this setup has built mutual trust. They know neither needs approval for personal spending. That trust removes tension and makes daily decisions easier.

Jerry / IG / Romijn says that discussing finances was one of their first conversations during their nuptials. It was part of their “legal agreement.”

Romijn and O’Connell discuss money openly without blame or fear. Conversations about bank accounts are practical, not emotional. This way, money talks feel like teamwork instead of conflict.

The couple has adjusted their system as their daughters grew older. High school brought new costs, and they adapted. Their approach shows that a financial plan can shift without breaking the basic rules.

Eighteen years in, their method still works! Separate bank accounts combined with a shared ‘family pot’ have given them both freedom and unity. Their story offers a practical way to keep a marriage strong.