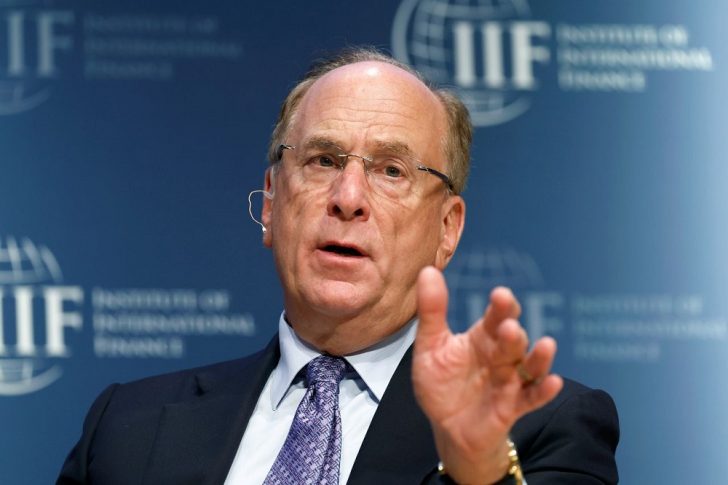

How Larry Fink Became the King of Wall Street

Larry Fink is a name that is synonymous with success in the world of finance. As the founder and CEO of BlackRock, he has led the company to become the world’s largest asset manager, with over $9 trillion in assets under management as of 2021. But Fink’s success goes far beyond just the financial industry.

He has been recognized for his leadership, philanthropy, and advocacy on climate change and diversity issues. Here are some more interesting facts about Larry Fink:

Early Life and Education

Larry Fink was born in Van Nuys, California, on November 2, 1952. He grew up in a middle-class family and attended the University of California, Los Angeles (UCLA), where he earned a degree in political science. After graduation, Fink received an MBA from the Anderson School of Management at UCLA.

Ting Shen/ Bloomberg/ Getty Images | Fortune befriends the bold

Career

After completing his MBA, Fink started his career at First Boston, working in the bond department. He then worked for several other financial firms, including Blackstone and Lehman Brothers, before founding BlackRock in 1988.

Under Fink’s leadership, BlackRock has grown into one of the world’s largest investment management firms, with over $7 trillion in assets under management. Fink is known for his fixed-income securities expertise and ability to anticipate market trends.

Philanthropy

In addition to his work in the finance industry, Fink is known for his philanthropic efforts. He has donated millions of dollars to various charitable organizations, including the Robin Hood Foundation, which aims to fight poverty in New York City. Fink has also established the Fink Family Foundation, which supports education, medical research, and the arts.

Climate Change Activism

Fink has been an outspoken advocate for action on climate change. He has called on business leaders and politicians to take action to address the issue, and he has committed BlackRock to become a more sustainable and responsible investor.

J.P. Donlon/ Getty Images | He is BlackRock’s current chairman and CEO, an American multinational investment management corporation.

In his annual letter to CEOs in 2020, Fink announced that BlackRock would make sustainability a key focus of its investment strategy. He also announced that BlackRock would be divesting from companies that generate more than 25% of their revenue from thermal coal production.

Political Involvement

Fink has been involved in politics throughout his career. During the Obama administration, he served as an economic advisor to former New York City Mayor Michael Bloomberg and was a member of the President’s Working Group on Financial Markets.

In 2020, the Joe Biden administration mentioned Fink as a possible candidate for Treasury Secretary. While he did not ultimately receive the position, Fink has continued to be involved in politics, speaking out on issues such as income inequality and the need for government action on climate change.

BlackRock’s Growth

Fink founded BlackRock in 1988, which today is one of the largest investment management firms in the world, with offices in more than 30 countries.

BlackRock’s growth has been partly fueled by a series of strategic acquisitions, including the purchase of Barclays Global Investors in 2009, which added over $1 trillion in assets under management to the firm’s portfolio.

Rob Kim/ Getty Images | To finance longer life spans, we must convince individuals to start investing now for the long term

Awards and Recognition

Fink has received numerous awards and accolades throughout his career. In 2014, he was named Financial Times’s “Person of the Year” for his role in shaping the global financial industry. He has also been included in Forbes’ list of “The World’s Most Powerful People” multiple times.

In addition, Fink has been recognized for his commitment to diversity and inclusion in the workplace. BlackRock has been named one of the “Best Places to Work for LGBT Equality” by the Human Rights Campaign Foundation for several years.

More in Crowd Funding

-

`

How to Align ESG Goals With Your Business Strategy

In today’s corporate landscape, aligning a corporate foundation’s ESG goals with the core strategies of a business has become increasingly crucial....

October 3, 2024 -

`

Vale Ventures to Invest in Mantle, A Startup for Carbon Capturing

In a bold move towards a greener future, Vale Ventures has made headlines by announcing an investment in the Boston-based startup...

September 25, 2024 -

`

Is Selena Gomez a Billionaire?

Recently, rumors of Selena Gomez’s billionaire status, fueled by her ever-expanding business ventures and skyrocketing influence, have gained traction. Gomez, who first...

September 18, 2024 -

`

New ‘Medicare Card’ Scam Is On the Rise – Here’s What You Should Do

Have you recently received a call asking you to verify your Medicare number to get a new card? If so, be...

September 13, 2024 -

`

What Is a Stock Split? Understanding How It Works

Stock splits are a fascinating aspect of the financial world that often pique investors’ curiosity. When a company announces a stock...

September 6, 2024 -

`

Cardi B No Makeup: Proof That She’s a Natural Beauty Queen

Cardi B is known for her bold and extravagant style, often capturing attention with her vibrant fashion choices and daring beauty...

August 31, 2024 -

`

How Long Has Forbes Been in Business? – And What Lies Ahead

For over a century, Forbes has been a pillar of business journalism and financial reporting. Since its inception in 1917, Forbes...

August 21, 2024 -

`

Are House Prices Going Down in Orange County in 2024?

In June 2024, Orange County saw a notable shift in its real estate landscape. This leads many to wonder if house...

August 14, 2024 -

`

What Are Specified Investment Products? SIPs Explained

Navigating the world of investing can be complex, especially when it comes to Specified Investment Products (SIPs). These financial instruments often...

August 7, 2024

You must be logged in to post a comment Login