Tips To Prepare Yourself For a Stock Market Crash

A stock market crash occurs when the market index falls dramatically in a single day or a few weeks of trading. These crashes typically occur when a sudden negative event strikes businesses and other ventures. While market volatility can be unsettling for investors, experts warn against panic selling or attempting to time a market correction. Such cyclical movements can be a good time to reassess your asset allocation. If you are concerned about the risks, you can move a portion of your portfolio to a less risky stock to protect your money from a potential market correction.

Here are some other precautions you could take if the market crashes:

Search out for dividends

Pixabay/ Pexels | You must always be prepared for the unexpected

Market downturns can be an excellent time to let your dividends drive your investment decisions. Many businesses distribute their profits to shareholders in the form of a small dividend yield each year. A dividend is the distribution of a company’s profits to its eligible shareholders; the process is similar to how banks pay interest to their savings account holders.

These amounts, however, are not guaranteed and may vary depending on the company’s needs and profit rate. Dividend-paying companies are less volatile and more mature, allowing investors to enter during market downturns. There will always be profit as long as dividends are paid out through the company.

Make a plan and make decisions based on it

Keeping to an overall plan is the best thing you can do during a market downturn. Investors who are nearing retirement must manage their risks to avoid the harshest effects and anxieties of a downturn. If you begin investing aggressively, you must change your investment mindset to protect your assets from taking excessive risks. Investing is all about safeguarding your assets while seeking potential, low-risk profits.

BJ Cook/ Stock Image | Buy what you know

Don’t leave your stocks

Stocks have historically been a good inflation hedge, with some sectors performing better than others, so financial planners advise against selling stocks or equity-based funds. Investors own stocks mainly to earn a return on their investment. When stock prices rise, it aids in capital appreciation and dividend payments; this is because the stock market’s returns frequently outpace inflation, which can help slow or prevent the negative effects on taxes. Investing in different companies allows you to save money and protect it from inflation and taxes.

Dividends are regular payments made to shareholders by many companies. Not all stocks pay dividends, but those that do usually do so quarterly. Dividend income can be used to supplement an investor’s salary or retirement income. Investing in stocks can also help you generate passive income after you retire or lose your job. Companies are best positioned to adjust to inflation because they can pass on cost increases to consumers while maintaining profit margins and share prices.

Asset Allocation

Pixabay/ Pexels | In the short run, the market is a voting machine

Since market declines are unavoidable, spreading your money across different asset baskets is better. In fact, having an appropriate asset collection is essential for reducing investment risks and smoothing your ride through market ups and downs. Diversifying your investments can be accomplished through 401(k) plans or by investing in a variety of assets within an asset class.

You can also invest in the international market to reduce risks and balance your portfolio, or you can diversify your portfolio by investing in publicly traded asset classes such as stocks, bonds, and cash. Commodities, collectibles, structured products, real estate, and private equity are examples of alternative investments.

More in Investments & Savings

-

`

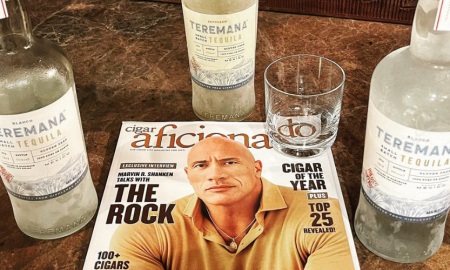

The Rock Tequila Takes Center Stage as Tequila of the Year

Dwayne “The Rock” Johnson isn’t just a wrestling legend and Hollywood A-lister; he’s also the mastermind behind a tequila brand that’s...

April 19, 2024 -

`

World’s Second Richest Man Elon Musk Lives in A Shockingly Simple Two-bedroom House

When you think of Elon Musk, images of cutting-edge technology, space exploration, and high-end electric vehicles might spring to mind. However,...

April 12, 2024 -

`

How to Calculate Retained Earnings

Have you ever wondered what keeps a company ticking financially beyond its immediate profits and losses? The secret sauce, often overlooked...

April 5, 2024 -

`

Silicon Valley Bank Stock (SVB) Marks A Significant Milestone

Silicon Valley Bank stock has been a topic of intense discussion and speculation in the financial world. Recently, it marked a...

March 30, 2024 -

`

How Much Does It Cost to Get a U.S. Passport in 2024?

When planning for international travel, understanding passport costs is crucial. You might find yourself asking, “How much is a passport?” The...

March 23, 2024 -

`

The U.S. Money Supply is Shrinking to A Historic Low Ringing the Alarm Bell For Investors

In an unexpected twist that could herald significant changes in the stock market, the U.S. money supply is charting a path...

March 14, 2024 -

`

Travis Kelce Leaves Australia for Super Bowl Win Celebrations After Taylor Swift Date

Travis Kelce and Taylor Swift are continuing to captivate fans as the new beaus ‘go deep’ in their love story. The...

March 9, 2024 -

`

How Generative AI Is Taking Over Capital Markets

Forget the grainy, monotone robots of sci-fi movies. Generative AI, the next frontier in artificial intelligence, is poised to revolutionize the...

March 2, 2024 -

`

The Dating History of “Riverdale” Star Cole Sprouse

Cole Sprouse’s journey stands out for its depth, discretion, and palpable shift from public spectacle to private sentiment. From his early...

February 20, 2024

You must be logged in to post a comment Login