Learn These Financial Lessons In Your 30s If You Want to Enjoy Your 50s

It almost feels like yesterday when you were in high school and making decisions about what you are going to do once you graduate. Unfortunately, once you do graduate, you’re hit with the sudden realization that you might not know it all.

This is what life looks like for most people. Some spend their college years hopping majors and enjoying their lives. Still, the moment they enter into the practical world, they struggle with the new responsibilities such as taxes, debts, and loans, and the reason why they have such a hard time is that they are not financially educated.

Pexels | It is encouraged for young people to become more financially aware and take their finances seriously

If you’ve passed your 20s and are worrying about finances, then don’t fret because it is not too late just yet.

Here are some lessons for millennials to take control of their financial situation.

1. Budgeting is Your Friend

For most young people, budgeting is off the table. They prefer to use their money as soon as they get it, and that results in messy finances and not having enough to make it through the month.

Call it the thrill of adrenaline and the fact that you get what you want, but this mentality can prove to be quite harmful, especially for people entering their 30s. By budgeting, you’ll be able to save money and resist the temptation to spend extra, and you won’t have to worry about stretching the paycheck to the last date.

Pexels | This is why budgeting is a friend and not an adversary – make good use of it

2. Take a Chunk Out for Saving

Evaluate your finances, income, bills, loans or debts, and calculate an amount that you can save every month. If you live with your parents and don’t pay rent, then you’ll have a good 30% of your income to put to good use – dedicate it to saving. If you have a lot of financial responsibility, you can still manage to take out some money without disturbing your duties.

3. Become Debt-free

Ask anyone who has paid off their debts and they’ll surely tell you that it is a wonderful feeling to get that burden lifted. This is why you should also put some focus on repaying your debt. Student loans are quite common, but they are also quite burdensome, and with the way interest rates work, they can sure give you a tough time. So rather than spending your 60s working and not relaxing, start working on resolving your debts now.

Pexels | Take help from family or friends if you’re struggling to get your finances right at the beginning

You might have a degree in STEM or social sciences, but if you are not financially educated, you might end up making mistakes that may take years to recover from.

More in Investments & Savings

-

`

How to Spend Money to Maximize Your Happiness

Money can not buy you happiness, or so the old saying goes. But let’s be real for a moment: Having a...

December 6, 2023 -

`

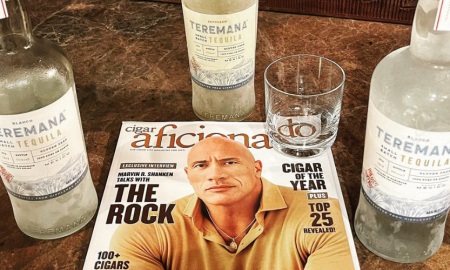

Brad Pitt’s Potential Retirement Plans

Hollywood superstar Brad Pitt is making headlines again, and this time, it’s not about his latest blockbuster or a high-profile relationship. Recent...

November 29, 2023 -

`

How to Rebalance Your Portfolio to Stay on Track

Investing can be rewarding, but the journey to success is not without its twists and turns. Maintaining a well-balanced portfolio is...

November 20, 2023 -

`

Why Millennials Are Investing in Real Estate

In recent years, there has been a noticeable shift in the real estate landscape, with an increasing number of Millennials diving...

November 18, 2023 -

`

Nina Dobrev and Julianne Hough | From Friends to Business Partners

In the world of wine, where passion meets business, best friends Nina Dobrev and Julianne Hough prove that mixing friendship and...

November 7, 2023 -

`

Cha-Ching! Dr. Dre’s Ex-Wife’s $100 Million Divorce Settlement

In the world of Hollywood’s tumultuous divorces, Dr. Dre and his ex-wife Nicole Young’s split takes center stage as one of...

November 1, 2023 -

`

Joe Jonas and Sophie Turner’s Surprising Showbiz Wealth

Joe Jonas and Sophie Turner, the power couple of Hollywood, have managed to amass quite a fortune during their illustrious careers....

October 29, 2023 -

`

10 Best Money Tips to Secure Your Financial Future

Money is vital in our lives, impacting our day-to-day well-being and long-term financial security. Whether you aim to save for a...

October 19, 2023 -

`

The World’s Richest Celebrity Couples

Love and fame are not mutually exclusive, and when the two worlds collide, they create a magnetic force of success and...

October 3, 2023

You must be logged in to post a comment Login