Struggling With Debt? Here Are Some Tips to Help You

The moment you graduate high school and step into practical life, you are hit with bills, loans, and all sorts of financial problems that lead you to take on some sort of debt.

Though it’ll be of little comfort, you are not alone in this struggle. Financial experts bring forward a grim statistic that shows that 80% of the American population is under debt, which means 8 out of every 10 Americans have bagged some sort of consumer debt. If there is anything that this estimate does, it highlights the question of why is there a huge chunk of the population dealing with debt?

Pexels | The simple answer to this question is the lack of financial education

When young people step out of their comfort zone, they are confronted by all sorts of decisions that they did not deal with before, such as rent, bills, and other requirements. Because they have no proper knowledge on managing their finances, they opt for loans, which is like drinking alcohol on a weekday – it is fun for a while, but it only makes matters worse.

So, if you’ve fallen for this ‘quick fix’ and are now dealing with debt, then worry not, here are some tips to help you.

1. Assess and Evaluate

A wise move before you start calling the shots would be to see where you stand financially. The first thing you are going to do is make yourself a cup of coffee because this will require your undivided attention. You will examine your sources of income, your spending, bills, and everything in between.

Pexels | By the end, you’ll have a clear vision of what your financial situation looks like

2. Budgeting It Out

Many people consider ‘budgeting’ to be exclusive to low-income people but in reality, people who budget are the smartest. Think of it like this – when you budget, you basically put aside money for your necessities and you are now left with money that you can save. Budgeting can also put a lot of things in perspective. For example, it can help you reduce your spending and it can also help you eliminate certain commodities that you don’t need.

3. Interest-free Options

There are a lot of banks that provide different packages to their clients; your job is to find the one that works the best for you. Opt for a bank that offers relatively low charges rather than losing a good chunk of your earnings into interest or some hidden miscellaneous charges.

Pexels | You’ll find the bank most suited to your requirements after thorough research

So don’t just sit around mulling over the debt you’ve collected. Instead, use these tips to get started on your journey to being debt-free.

More in Investments & Savings

-

`

Nvidia’s Meteoric Rise: Stock of the Year – But Can It Soar Higher?

Nvidia, the California-based chipmaking behemoth, haa undeniably had a stellar year, emerging as the top-performing S&P 500 stock in 2023 with...

December 19, 2023 -

`

Mastering Stock Tracking With Google Finance in Google Sheets

In the dynamic world of finance, managing your stock portfolio efficiently is key to making informed decisions. Google Finance, a powerful...

December 14, 2023 -

`

How to Spend Money to Maximize Your Happiness

Money can not buy you happiness, or so the old saying goes. But let’s be real for a moment: Having a...

December 6, 2023 -

`

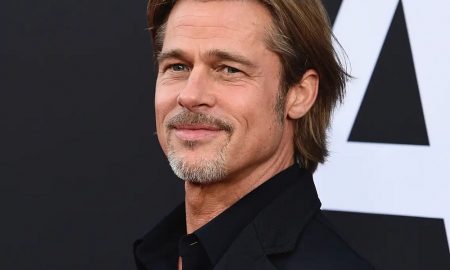

Brad Pitt’s Potential Retirement Plans

Hollywood superstar Brad Pitt is making headlines again, and this time, it’s not about his latest blockbuster or a high-profile relationship. Recent...

November 29, 2023 -

`

How to Rebalance Your Portfolio to Stay on Track

Investing can be rewarding, but the journey to success is not without its twists and turns. Maintaining a well-balanced portfolio is...

November 20, 2023 -

`

Why Millennials Are Investing in Real Estate

In recent years, there has been a noticeable shift in the real estate landscape, with an increasing number of Millennials diving...

November 18, 2023 -

`

Nina Dobrev and Julianne Hough | From Friends to Business Partners

In the world of wine, where passion meets business, best friends Nina Dobrev and Julianne Hough prove that mixing friendship and...

November 7, 2023 -

`

Cha-Ching! Dr. Dre’s Ex-Wife’s $100 Million Divorce Settlement

In the world of Hollywood’s tumultuous divorces, Dr. Dre and his ex-wife Nicole Young’s split takes center stage as one of...

November 1, 2023 -

`

Joe Jonas and Sophie Turner’s Surprising Showbiz Wealth

Joe Jonas and Sophie Turner, the power couple of Hollywood, have managed to amass quite a fortune during their illustrious careers....

October 29, 2023

You must be logged in to post a comment Login